Tuesday 25 September 2012

ITRA reports - a 13th person sentenced for timeshare marketing fraud

Wednesday 19 September 2012

ITRA - Timeshare Pitches that could be a scam

Thursday 13 September 2012

ITRA | Avoiding Timeshare Fraud When Getting a Timeshare Refund

Monday 10 September 2012

ITRA | Why File a Timeshare Class Action Lawsuit?

ITRA is the best option since it is cheaper than instituting legal action by yourself, you will get the best lawyers from the likes of ITRA and Owners Action, and you will get unparalleled convenience. You are more likely to get a Timeshare refund in a law firm because your legal team will be more formidable compared to an individual lawyer. Why should you take action against those in the

Timeshare industry if you are a victim of Timeshare fraud?

You should take action because under the law, you have the right to seek Timeshare refund as well as to get compensation for the distress and damages if the timeshare purchase is not of merchandisable quality.

Taking class action is allowed in England and Wales under GLO (group litigation order). You can even participate in a class action lawsuit if you are outside England and Wales, provided the defendant is within the territories.

You should take action because it will not be detrimental to your pockets. Under the GLO, the class action will be handled on a no-win no-fee basis. This means the lawyers will only get a fraction of the payout if you win the case and will not get anything if you lose. The ITRA and Owners Action fund the claim and offer support throughout the case.

Filing a Timeshare class action lawsuit is important because you will recover any investment that you will have made. This could prevent your financial ruin, especially if you are a pensioner.

Suing the guilty party is important because you will feel good about it, even if you do not win.

Instituting legal proceedings is a way of raising awareness about Timeshare fraud. By raising awareness, you will be helping others avoid falling into the same trap you fell into. You should take legal action because there is precedence of huge payouts. Provided you have a strong case, you are almost assured of a payout. Taking part in a class action lawsuit is important if you do not have a very strong case since you will ride on the stronger cases of other Timeshare fraud victims.

ITRAs objective is to support the consumer in timeshare disputes. We have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

Thursday 6 September 2012

ITRA - What Makes a Good Timeshare Refund Claim Funder?

The best way to go about suing players in the Timeshare industry is through Timeshare class action. In English and Welsh courts, the group litigation order (GLO) guides these lawsuits. You could also participate in a lawsuit from outside England and Wales if the defendant is English or Welsh. Filing a lawsuit when you have just lost your money is not feasible and it is often necessary that you get help from Timeshare claim funder. As the term suggests, a claim funder funds your entire case for a fee if you win. So, what makes a good Timeshare fraud claim funder?

Monday 3 September 2012

ITRA - Tips on Hiring a Lawyer for Timeshare Class Action from Owners Action

ITRA

You could file an individual lawsuit, but a class action lawsuit has more advantages since you can access a more qualified lawyer, you get to share litigation fees, and you do not need to pay if you lose the case since the class action lawsuit lawyer will only be paid a commission if you win the case. So, how do you go about hiring a class action lawsuit lawyer to handle Timeshare fraud?Tuesday 24 April 2012

Tips on Avoiding Timeshare Fraud from International Timeshare Refund Action

International Timeshare Refund Action

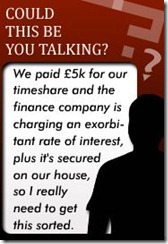

There has been an increase in timeshare complaints. People are complaining of abuse, timeshare fraud such as shady collection firms like QVC or Quality Vacation Club, high interest rates by financiers recommended by marketers, complex Internet advertising scams, and being lured by timeshare representatives using bribes. Other complaints are escalating maintenance fees, problems with the transfer and disposal of points and weeks, and problems getting selected balanced exchanges from exchange companies. You could avoid seeking a timeshare refund in the first place by avoiding buying on the spot. Any company that pressures you into buying a timeshare on the spot is most likely up to no good. Companies or Resorts (such as Disney) will gladly give you a number to their sales office if they cannot get you to buy then and there, but scam companies are not likely to take no for an answer.

You could avoid seeking a timeshare refund in the first place by avoiding buying on the spot. Any company that pressures you into buying a timeshare on the spot is most likely up to no good. Companies or Resorts (such as Disney) will gladly give you a number to their sales office if they cannot get you to buy then and there, but scam companies are not likely to take no for an answer. Have a lawyer review the contract. If you are going to be bothered into signing a contract, at least make sure the company allows you to have a lawyer review it before you give in and sign on the dotted line. A trained eye will be able to tell in a heartbeat whether a deal is legitimate, so do not leave it up to chance. If the company will not give you a copy for your lawyer to examine, odds are they are crooks.

Research the company. With the emergence of smart phones, this step has never been easier. While listening to the presentation, conduct an internet search on the company. Pay attention to any testimonials you come across. Odds are if this company scammed someone before, the victim will have made a public complaint online. If you are not at the presentation, and are speaking to a sales person over the phone, just use your home computer.

Always read the fine print. This tip even applies to legitimate companies, but it is especially important when you suspect the deal might be a scam. There might be hidden fees or other such traps in your contract, so be diligent when reading. Do not skip a single word, especially if it is in smaller print.

Never pay an up-front fee. If a timeshare resale company requires a payment up-front before the timeshare sale is final, walk away. The timeshare resale company may call the fee by any number of different names such as an appraisal fee, a market analysis fee, an initial advertising fee, or something similar. If there is any type of fee that requires a prepayment before the timeshare is sold, the consumer is likely to lose that money and never get their timeshare sold.

Check with consumer protection agencies. Another important tip is that you should not believe everything timeshare presentations promise. Always be sceptical, particularly avoiding anything that promises you too much too quickly.

International Timeshare Refund Action

If you feel you may have been scammed, you need not spend a fortune filing a timeshare law suit. With the increase in timeshare complaints, Owners Action and International Timeshare Refund Action (ITRA) are offering the opportunity for timeshare owners to participate in a timeshare class action.

To find out more, visit the ITRA websiteMonday 16 April 2012

International Timeshare Refund Action - New US visa scheme being debated

The Visa Improvement to Stimulate International Tourism to the United States of America (VISIT-USA) Act has several parts but includes the creation of a new non-immigrant visa, renewable every three years, for overseas investors who spend at least $500,000 to purchase single-family homes in the United States. In order to be eligible, those applying must spend at least $250,000 on a primary residence where they will reside for at least 180 days out of the year while paying taxes to the U.S.

The Visa Improvement to Stimulate International Tourism to the United States of America (VISIT-USA) Act has several parts but includes the creation of a new non-immigrant visa, renewable every three years, for overseas investors who spend at least $500,000 to purchase single-family homes in the United States. In order to be eligible, those applying must spend at least $250,000 on a primary residence where they will reside for at least 180 days out of the year while paying taxes to the U.S. The debate comes as a new act, allowing the US to take action against fraudulent timeshare companies, has just become legislation.

The Timeshare Resale Accountability Act will force companies to offer easier get out clauses for investors, and also to be more upfront about the terms of their products. Penalties will be applied to companies which fail to apply.

International Timeshare Refund Action

Our current UK Class Action claim is only for members of RCI Europe. This is because of legal corporate jurisdiction. RCI have many different companies operating under their banner throughout the World. For example, in the USA RCI trade as RCI - LLC which is an American company. They have recently made a settlement for their wrongdoings to their USA week’s owners and a claim by point’s owners is still ongoing.We have recently appointed ITRA licensed agents who have opened offices in Singapore, South Africa and Australia who are pursuing claims and action where appropriate against RCI, resorts and management companies locally in much the same way of our European current operations.

Contact International Timeshare Refund Action for more information: www.itra.net

International Timeshare Refund Action

Florida Timeshare Resale Accountability Act Affords Consumer Protections

International Timeshare Refund Action

International Timeshare Refund Action (ITRA) is encouraged by the Florida Legislature’s passage of the Timeshare Resale Accountability Act, sponsored by Florida State Senator Andy Gardiner and Florida State Representative Eric Eisnaugle and supported by Florida Attorney General Pam Bondi.“Florida has taken a giant step in providing consumer protection against fraudulent and deceptive business practices utilized by unsavory timeshare resellers,” said Howard Nusbaum, president and CEO of ARDA (American Resort Development Association). “The timeshare industry plays an increasingly significant role in Florida’s recovering economy as tourism returns and grows in the state”.

The Timeshare Resale Accountability Act protects Florida consumers and helps put an end to deceptive marketing practices conducted by fraudulent timeshare resale companies that have been targeting consumers under the guise of offering a service to help sell their timeshare product. Specifically, timeshare owners will be given more information to make better decisions about purchasing timeshare resale services. For example, the legislation seeks greater transparency and will require, among other things, timeshare resale companies to disclose all terms and conditions of their business relationship with a consumer, provide for a right of rescission for consumers to cancel a contract for resale services, and impose penalties on companies who continue these deceptive practices.

The Timeshare Resale Accountability Act protects Florida consumers and helps put an end to deceptive marketing practices conducted by fraudulent timeshare resale companies that have been targeting consumers under the guise of offering a service to help sell their timeshare product. Specifically, timeshare owners will be given more information to make better decisions about purchasing timeshare resale services. For example, the legislation seeks greater transparency and will require, among other things, timeshare resale companies to disclose all terms and conditions of their business relationship with a consumer, provide for a right of rescission for consumers to cancel a contract for resale services, and impose penalties on companies who continue these deceptive practices. Nearly 25 percent of all timeshare resorts in the United States are located in Florida, and these resorts represent a large and growing share of Florida’s tourism market. The Timeshare Resale Accountability Act is proactive legislation that is vital to ensuring the long-term health of a key sector of Florida’s tourism industry by protecting timeshare owners and legitimate businesses alike.

International Timeshare Refund Action has entered into dialogue with thousands of timeshare owners from which we have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

ITRA now has many thousands of UK claimants who are joining our NO WIN – NO FEE action group to claim compensation from RCI for irregularities including skimming and renting high season weeks from their Spacebank to the detriment of their members. This case is currently being rigorously pursued and is at an advanced stage with our legal team. Full details and an online pre qualification form may be found within our website. www.itra.netInternational Timeshare Refund Action

Tuesday 10 April 2012

International Timeshare Refund Action–Survey Reveals Brits Like to Return to Same Resort

The British are officially creatures of habit! According to a new survey by RCI, the timeshare exchange company, nearly two-thirds (65%) of Brits have returned to the same holiday resort more than once, revealing people like familiarity when it comes to their holidays. Surprisingly, more than one in ten (11%) of respondents said they had returned to the same resort six times or more!

With over a third of people (36%) now taking fewer holidays than normal, it seems holidaymakers want to remove the risk of having a disappointing break. Returning to somewhere they have been before and enjoyed seems to have been given higher priority than having different experiences.

Sean Lowe, managing director of RCI, said: “We commissioned the research to gain insight into people's holiday habits and what is important is guaranteeing they have a good time. While travelling and trying different experiences suits some people, it’s apparent that ensuring a consistent quality and knowing what you’re buying is important to many which is why timeshare holidays and holiday exchange have remained popular. Over a third (35%) of the people we surveyed who ‘repeat holiday’, said they would actually try a different holiday if they knew they would get a similar experience.”

Other holiday habits:

- ‘Familiar fun’ – nearly half (43%) of people tended to do the same activities and 6% saying they did the exact same things

- ‘Repeat eating’ – nearly a third (30%) of people surveyed said they went back to the same place to eat/drink

- ‘Meal monotony’ – 18% of people said they will only eat food they are familiar with and 12% said they order the exact same meal

- ‘Bay Watch’ – one in 20 (5%) people said they actually wait and then take the first opportunity to get their usual spot on the beach or by the pool!

* The survey was conducted by Online Opinions, and featured 1,000 adults who were polled online between 24-27 February 2012.

Whilst returning to the same resort every year may be a popular choice for any Brits, here at International Timeshare Refund Action (ITRA) we have found that owning a timeshare is not necessarily the ideal holiday solution that many timeshare owners had hoped.

We have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners. Many timeshare owners have found that rising maintenance fees and difficulty in obtaining suitable exchanges from companies like RCI have rendered their timeshare ownership virtually unusable and un-economical.

At International Timeshare Refund Action (ITRA) our objective is to support the consumer in timeshare disputes.

To find out more about the International Timeshare Refund Action visit our website www.itra.net

Monday 9 April 2012

ITRA - Time Share Resale Scams Surging

Throughout the country, thousands of time-share owners are doing their utmost to rid themselves of properties that they no longer need or want. Unfortunately, for them there is an abundance of timeshare scams surging fees for paperwork and sales processing are taken upfront on the pretext of having buyers, which do not materialise. The result of course, is a no sale and the fee money paid is lost.

ITRA – Standing against Timeshare Fraud

An example of the scams taking place is shown when a Yuba City couple, Doug and Armelita Stoddard, bought a one-week timeshare in the Napa Valley some years ago. They ended up hardly using the property and trying to sell it online, they discovered a Florida based company who ‘found a buyer’ within weeks. However, they first had to send fees of $3,000 in two cashier checks, by overnight delivery.

Needless to say, after paying the checks, the company disappeared without a trace. This is a good example of the timeshare scams emerging repeatedly, designed for the sole purpose of taking gullible and desperate people for a financial ride.

Timeshare scams surge, when the economy is on a downturn, as by necessity there is a ready market to target. There are people who desperately needing money, want to dispose of their timeshare, as they can no longer afford the upkeep of them. They become easy targets for fraudsters, who take full advantage of the situation by making promises but failing to fulfil them.

Many of these so- called companies are not legitimate real estate brokers. Legally, a realtor requires to be licensed in the state in which the timeshare is located.

Claiming by phone or email to have potential buyers, either local or foreign, they get your attention. The next step is asking for upfront money for various expenses. Be aware, and react carefully to what is offered before parting with your cash, in order to avoid being scammed.

Source: Inaudit to read or comment on the original article click here

ITRA – on your side

If you feel you have been a victim of a similar scam contact us now.

To find out more about the International Timeshare Refund Action visit our website www.itra.net

Tuesday 27 March 2012

ITRA - Timeshare fraud victims targeted by double-dip scam

Fraudsters are offering to secure compensation for timeshare owners desperate to escape a holiday property contract – in return for a further fee.

ITRA – Righting the wrongs with Timeshare

Timeshare owners who have fallen victim to fraudsters offering to sell their contracts in exchange for a fee are being targeted a second time by the same crooks promising they can obtain compensation – for a further fee of at least £500.

Timeshares, also known as "fractional ownership", became popular in the UK in the 1980s when waves of Brits snapped up shares in holiday apartments at European coastal resorts, typically in Spain and Portugal. According to the latest European Timeshare Industry Report, Britons and the Irish form the largest market in Europe, with 589,653 timeshare owners out of a European total of 1.5 million.

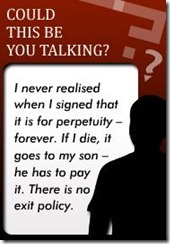

Contracts written in perpetuity are difficult to break. Many retired timeshare owners are locked into paying high annual fees for an entitlement to holiday properties they do not want. In many cases, these are passed on to family members when the original purchaser dies.

The problem is exacerbated because timeshare contracts are notoriously hard to sell. The company that sold the timeshare may agree to buy it back, or a resale company might find a new buyer – but the price owners get is usually much lower than the one they paid. Worse, bogus resale companies are prolific, offering to find a buyer if owners give them an upfront payment, then disappearing with the cash.

This happened to Craig Williams and his wife Jacquie from Kinross, who have a timeshare at the Moness resort in Aberfeldy, Perthshire. The couple were cheated out of £500 in 2006 by a company called Yacht Trading. It failed to find a buyer for the Williams's timeshare and never paid back their £500. Yacht Trading was wound up in the high court in early 2008, following a government investigation.

Recently the Williams were again contacted by a timeshare-related company, this time called Asset Accountancy Services (AAS). The company claimed it was in a position to retrieve the money the couple had lost in the Yacht Trading scam.

"The salesman told us there was a £4.5m pot of money available to compensate people who had been conned and promised us £2,717.10, which was a lot more than we had lost," Williams said.

"I instantly thought it must be a scam, even though the guy on the phone was professional and gave us his company registration number to reassure us. He also gave my wife the number of the 'Legal Time Share Advisory Bureau' in Gateshead, which he said was some kind of government body for timeshare organisations. But when we rang it later, the woman on the line did not sound very authentic."

The Legal Time Share Advisory Bureau does not appear to have any kind of presence on the internet and when AAS called back, Williams challenged the salesman. "The man said it wouldn't have a website because it was a government body." He then asked the couple to buy £500 in vouchers from online payment service Ukash to cover administration fees, and to call the claims management company back with the voucher codes. Williams suspected they would never see the £500 again if they proceeded.

"At that point I said it all sounded like another scam. He asked who I was so I pretended I was a trading standards officer, at which point he began getting aggressive, especially when I wouldn't give him my name. He must have figured it out because at the end of the call he said: 'You're nothing but a twat. We've got your wife's number now so we'll make sure she gets lots of calls.' It was very threatening."

David Hunter, chief executive of Ukash, said: "We're aware and clearly concerned about fraudulent activity of this type but, for us it's impossible to differentiate between genuine and malicious transactions."

He said if consumers reported a fraudulent transaction to Ukash within eight hours, there was a 50% chance they could stop it going through. He advised people to check the Ukash security tips for more safety advice.

Double-scamming of victims is nothing new. In early March we reported on victims of telephone fraudsters selling bogus energy-saving devices, who were being targeted by the same people claiming to offer compensation. Trading standards warned that the bogus "claims management companies" were offering to secure up to £3,000 in compensation in return for an initial outlay of £300.

Asset Accountancy Services gives an estate in Colchester as its address, but according to Companies House the company has changed premises five times since November 2011. When the Observer tried to get in touch, the phone line was dead.

A spokesman for the Timeshare Association (Tatoc), a consumer association that can help with resales and timeshare problems, said Asset Accountancy was a name that had only recently cropped up. "We've had a few calls about this one now, but all these firms are completely bogus and consumers need to stay away," he said.

"They start off asking for £350 to £500 upfront, but then they will come back and claim they have retrieved £20,000 of compensation for a consumer before demanding £3,000 to £4,000 in order to 'pay the tax'. This is where the real sting takes place. "These tend to be companies who were involved in the original reselling scam, suddenly popping up as a legal recovery specialist a few years later – that's how they have their list of potential targets."

A new EU directive, which all member states had to adopt by February 2011, bans resale companies from levying charges until the actual sale has taken place or the contract has been otherwise terminated. This will help put a stop to widespread fraudulent activity from resale predators, but will do little to prevent bogus companies from contacting previous victims.

The directive also includes rules that might help protect buyers and their families being lumbered with timeshare contracts indefinitely. For example, traders must provide comprehensive pre-contractual information so consumers can make an informed choice prior to being bound by any contract, and there is a universal 14-day cooling-off period during which consumers can pull out of the deal at no cost.

Grace Kerr, a property lawyer at Birketts solicitors, said: "It's very difficult to break a timeshare contract written in perpetuity. The new EU directive will help as it offers greater protection for new purchasers, but existing owners have few options. They can try selling to someone else or handing back ownership to the timeshare organisation (some are better than others and will allow this, usually if the owner is over 75 or unable to use their timeshare), or renting their weeks to someone else, which might help ease the burden.

"Failing that, they could walk away and simply stop paying the fees, but this would be breach of contract and they would probably face legal action. That only leaves the option of claiming misrepresentation, if they can prove they were told the purchase was something it is not, such as an investment, which might work. If the timeshare property is in the UK, the Trading Standards Institute might be able to help."

Tatoc warns against directly contacting any company that promises to cancel your timeshare agreements at low cost. It advises timeshare owners to call its own helpline (Tel 0845 230 2430) to check first. Citizens Advice says anyone thinking of selling their timeshare should talk to one of its advisers, and also recommends Tatoc.

Craig Williams said that he had contacted us to ensure that no vulnerable people fall victim to the double-dip scam. "If I can help stop one granny from being scammed out of her money, it will be worth telling my story," he said. "I wonder how many people got caught out on the day we were cold-called."

Source: Guardian

To comment on the original article click here

AT ITRA Our Aim Is?

Our objective is to support the consumer in timeshare disputes. We have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

To find out more about the International Timeshare Refund Action visit our website www.itra.net

ITRA

Tuesday 20 March 2012

International Timeshare Refund Action (ITRA) – Timeshare Law in Spain

Timeshare Law in Spain

Timeshare rights are those which give to the holder the right to use and enjoy an independent dwelling, with exclusive character, for a specific period of time within the year. It includes the necessary furniture for this use and any complementary services & facilities. It is regulated in Spain by a Law dated 1998.

The Spanish regulation considers timeshare as a type of seasonal rental. Crucially, the holder of timeshare rights does not acquire ownership rights, but the right to use the property for a specific period of time only. The duration of these rights is not indefinite; the developers of these type of complexes need to specify the period for the enjoyment of these rights which s always should be between 3-50 years. Outright ownership of the property remains the developers’.

Because the developer retains ownership, they can always sell ownership rights with the limitations derived from the existence of the other person’s use and enjoyment rights on the sold unit, which will remain for the contracted period.

Provision 1.4 of Law 42/1998 prohibited the denomination of those rights as “multiownership" or any other way containing the word “ownership", “ owner” or "property".

For this reason, any contract signed in Spain containing the word “ownership or property" (propiedad) is null and void and you have the right to a refund of any money paid, plus legal interest.

In Spain, the description that was finally chosen, as most appropriate, descriptive and loyal to Law is "derecho de aprovechamiento por turno", which literally means “right to use and enjoyment in shifts"

Publicity or promotion of these type of developments can never contain the word "propiedad"(property or ownership)

The timeshare scheme can only be formed in a building, property or set of them which are architecturally individual or separated. All independent units included in it, should be subject to the scheme. The building must have at least 10 units.

The same building can be subject at times to different tourist operations, provided that the rights of timeshare accommodations fall on concrete and specific periods and units.

The annual use/enjoyment period can never be less than 7 continuous days. In every case, within the same scheme, shifts should all have the same length. The units will also be reserved for repairs, cleaning or other common purposes for a period of time which shall not be inferior to seven days for each unit subject to the regime.

Main characteristics of timeshare rights in Spain are:

· It is a limited ownership right (enjoyment): two or more different people hold rights on the same property (the owners and the holders of enjoyment rights).

· It is immediate, as, in shifts, it gives to its holder a direct enjoyment of the property.

· It is entered in the Land Registry, which gives to its holder a complete legal safety within the Spanish legal system. Obviously timeshare rights need to be transmitted by Notary deeds for their entry into the Land Registry.

· It can be transmitted to others either in life or by death. They are part of the property trade.

Together with desisting from or cancelling the timeshare contract, possibilities that are subject to a shorter deadline, there is the possibility, initially sine die (without deadline) to apply for the nullity of the contract.

In what cases?

· When timeshare rights are transmitted disregarding the imperative Law which regulates them.

· When the transmission of timeshare rights are made before the scheme is actually constituted

· When there is a lack of veracity of information provided to the buyer.

The action for the refund of amounts linked to the nullity has a 15 years deadline.

There are numerous precedents in Spanish Courts for the nullity and refund of money if you were sold under the term "propiedad" (property).

The important issue of adaptation

From January 1999 any preexisting timeshare regime needs to adapt to this Law. If this has not happened, any holder of timeshare rights will be able to request a Judge to compel the developer to do so.

Adaptation will always require a Notary deed and proper registration in the Land Registry.

Adaptation will respect the nature of rights which were transmitted by virtue of the old private contract. If ownership was transmitted, this is how it will have to be registered after approval of a simple majority of Community of owners.

All old contracts will have a time limit of 50 years unless parties have agreed otherwise or parties mutually or freely agree in the adaptation deed on a different definitive or non-definitive period.

If the owner of the development does not comply with the obligation of adapting the regime to this new regulation, the holder of timeshare rights will have rights to cancel the contract with effective devolution of amounts and compensation of damages.

ITRA are now pursuing the coordination of a claim to the courts on behalf of timeshare owners who can justify due cause for full compensation, distress and damages on the grounds that their timeshare purchase was not of merchandisable quality.

To find out more about the International Timeshare Refund Action visit our website www.itra.net

Friday 16 March 2012

ITRA - Timeshare Class Action

Have you been a victim of a Timeshare resale scam?

ITRA - Timeshare Class Action versus Individual Timeshare Lawsuit

You could go for an individual Timeshare lawsuit or Timeshare class action. The greatest advantage of an individual lawsuit is the fact that you get to set your own terms, but going for Timeshare class action is more advantageous.

One of the greatest benefits of class action is the fact that you will not need to pay anything. Such companies as ITRA (international timeshare refund action) and Owners Action are dedicated to helping people action in Timeshare-related cases. Companies like ITRA work on a no-win no-pay basis, meaning you will only pay a fraction of what you win and nothing if you lose.

The company (ITRA) will be responsible for all the research and the cost of gathering the necessary evidence. The fact that the lawyer has to win to get paid means your lawyer is more likely to give 100% with class action. This is indeed the best option if the Timeshare fraud has taken all your disposable money.

You get greater judicial efficiency with class action. The fact that a number of people will only need one judge means the court system will appreciate such a case more. In individual lawsuits, plaintiffs who file early get more than the ones who file later. This is not a problem with class action. Class action is the best option if your case is not strong enough to win. Your case will be helped by the other cases.

With ITRA you will get the very best lawyers with a Timeshare class action suit. This is not possible with an individual suit since good lawyers are expensive. A class action lawsuit gives you unparalleled convenience. You will not be required to be in court every day, meaning the lawsuit will not affect your business/job or your social life. The legal system puts limitations on the period before which individual actions are to be filed, but the period is extended in class action suits. Timeshare players are more likely to offer compensation when faced with class actions.

ITRA

Our objective is to support the consumer in timeshare disputes. We have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

If you feel you have fallen foul of any of these Timeshare companies and want a solution? Contact ITRA today.

ITRA International Timeshare Refund Action

To find out more about the International Timeshare Refund Action visit our website www.itra.net

Wednesday 14 March 2012

ITRA Timeshare News - Don't get caught by old scams with new twists

For decades people have agreed to a free trip to attend half-day seminars — usually about timeshare condo investments in travel hot spots.

As people have become more savvy, con artists have changed their game, the Better Business Bureau says, prompting new warnings from the FBI and Federal Trade Commission.

ITRA Timeshare News Blog

A new phone call tactic nabbed one local man's moneyThurman Huddleston, 67, filed a complaint with the BBB after he wired more than $10,000 to a Dallas company promising to sell his timeshare in Cozumel, Mexico. He had visited the Reef Club condo about a dozen times since buying it in 1996, he said. Huddleston researched the company online and didn't see red flags so he sent the funds to cover closing costs.

"It sounded right, so I made the deal," Huddleston said.

Then the company couldn't be contacted.

Last year there were more than 2,600 complaints filed nationally with the bureau regarding timeshare companies. Some related to dates or management issues while others allege companies collected money then disappeared, as with Huddleston.

It's not the only scam still working. - “ITRA”

Source: Caller.com

To comment on the original article click here

ITRA

The above story is one that we here very often at ITRA from many of our clients.

The above story is one that we here very often at ITRA from many of our clients.Our objective is to support the consumer in timeshare disputes. We have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

If you feel you have fallen foul of any of these Timeshare companies and want a solution? Contact ITRA today.

ITRA International Timeshare Refund Action

To find out more about the International Timeshare Refund Action visit our website www.itra.netTuesday 28 February 2012

Wednesday 22 February 2012

RDO ACTIVITIES & SALICIOUS TIMESHARE WEBSITES

Who are the RDO?

The RDO are the Resort Developers Organisation, www.rdo.org originally based in Brussels and who have recently moved to a small office London. Their main sponsor is RCI who use them as a controlled credibility vehicle to protect their members resorts by alleging that everyone who is not one of their members is a crook.

Their “enforcement officer” is an ex Spanish policeman called Alberto Garcia, who has on their behalf launched a salacious site called www.mindtimeshare.me . If you look at their websites you will note that they are running an attack campaign against mainly ITRA in an attempt to discredit us to scare and dissuade potential claimants from dealing with us. This is inspiring because it shows how worried RCI are by our actions. We have launched a new website www.mindtimeshare.co.uk with only one page as a way of hitting back. Please read it and you see a challenge that we made to the RDO nearly two years ago to which we are still awaiting a reply. This will open your eyes and amuse you.

Timeshare Complaints –Timeshare Does Not Die With You!

The following letter was published by the Guardian together with their comprehensive reply. This story is sadly typical of the situation Owners Action hear from many disgruntled timeshare owners.

My wife's mother died recently and included in her estate was a week at a timeshare property in Scotland that she and her late husband had bought in 1988. When my wife informed the company, Macdonald Hotels, the owner had died she was told that her parents had bought the timeshare in perpetuity and that she and her two sisters were now liable to pay the annual maintenance fee, currently £450. Not only do they have to pay this ever-increasing annual amount but our children would become liable to pay them when we die and so on for time ever more. BL, High Wycombe, Bucks

Macdonald Hotels admitted that selling timeshare is difficult and it might take some time to sell this out-of-season week. Occasionally, some go at auction for almost nothing but that does at least free you from the annual charge.

I wondered if it is possible for a timeshare owner to avoid passing on the liability to beneficiaries. You can't simply leave the timeshare out of your will because it is still part of your estate. Nor can you choose to leave it to "no one". Executors are responsible for administering the estate and also for paying the liabilities, which includes ongoing annual fees. They do not have to use their own money but would have to liquidise other assets in the estate to pay fees until the timeshare is sold.

Your wife and her sisters could refuse to accept the timeshare but they would have to renounce their entire inheritance. They can't cherry pick the assets they want.

Another thought is donating the timeshare to someone with whom you have no connection, perhaps the supreme leader of North Korea. Some owners had managed to leave their timeshare to dubious characters in eastern Europe, through a PO Box number, but this idea is flawed. Macdonald charges an annual amount split between the owners – so the fewer who pay, the more it costs the others. To complicate matters further, the constitution says you can only sell your timeshare to approved people.

Macdonald has told you it is considering whether to accept back the weeks, paying you nothing in return, but first every owner, possibly 52 people, would have to agree to surrender their ownership or switch to a different property.

source: www.guardian.co.uk

One of the commonest timeshare complaints is that contracts pass to timeshare owners’ heirs when they die, who are then obliged to keep up the maintenance fees, which often increase at a much higher rate than inflation.

At Owners Action, we seek to support the consumer in timeshare disputes. To learn more about our services, visit www.ownersaction.com

Timeshare Fraud! Timeshare rep Claims Timeshare can Cure Cancer

The following article, published by www.moneysavingexpert.com, struck such a chord with us at International Timeshare Refund Action (ITRA) that we’ve reproduced most of it here.

Timeshare rep claimed: timeshare = no cancer

Pushy timeshare reps often use bribes to lure unsuspecting holidaymakers into parting with their life savings. But unfortunately for them, they’d picked up a MoneySaver…

Little did I know I was in for a three-and-a-half-hour sales ordeal that would use my own cash to hold me to ransom. They even claimed timeshares prevent cancer.

As I told them quite frankly at the outset, I had absolutely no intention of buying anything and was purely in it for the freebie. They were magnanimous – “That’s fine! There’s absolutely no pressure.” Considering the Rambo-esque sales tactics that followed, I’ve since decided they don’t consider anything short of a punch in the face as ‘pressure’.

Before I was allowed to attend, they checked I had all the ingredients for a mammoth impulse buy: earning above a threshold, partner in tow, and carrying an approved payment method. We were cheerfully packed into a minibus with a dozen other couples and told to enjoy our ‘free treat’ (final check: “Did you all say you have Mastercard? Good.”)

The minibus pulled up at a new hotel building, where we were herded upstairs to a windowless, low-ceiling conference room crammed with sales staff. Here are the tricks used in the sales pitches that followed, and more importantly, the survival strategies we used to grab the freebie and run.

The tactics they used:

-

The show ain’t over till they say so. On arrival, we had to put down a refundable cash deposit of about $50 and sign a form saying we would forfeit this, and the promised gift card, if we left before the timeshare pitch was finished (which had no specified end time – eek). There was no mention of this when we signed up, so we had no choice but to pay up or leave.

Incidentally, I say ‘about $50′, as bizarrely, neither myself or my partner can remember exactly how much it was. I can only assume it’s because a) it was sprung on us with absolutely no warning or b) the ensuing sales onslaught triggered a mild form of retrograde amnesia.

-

Wear ‘em down. The sales pitch started late in the morning and lasted several hours into the afternoon. We were greeted with tea and coffee at the start, but there were no further refreshments, nowhere to get lunch – and if you didn’t want to forfeit your freebie and deposit, no way to leave without their approval.

-

Divide and conquer. There were two parts to the pitch, starting with a presentation. Each couple was instantly assigned their own sales rep, who followed them throughout (more on this delightful practice later), and insisted on sitting with them during the presentation. Maximum sales patter, minimum privacy.

-

Share the love. Having stated only couples could attend the day, we were all made to publicly declare our love – one couple at a time, moving around the room – followed by a kiss. I’m not joking. Each was accompanied by loud, satisfied ‘aaaaahs’ from the sales staff, and immediately used for the “if you love them, you’ll buy them a timeshare” tactic.

-

Free chocolate. All at MSE Towers know this is my Achilles heel, and I must admit being pressured into spending tens of thousands on a holiday apartment is far more appealing when you add free chocs (incidentally, it was a Hershey’s kiss, woven into the presentation as reinforcement of the “love = timeshare” message).

-

Buy a holiday home and you won’t get cancer. Stay with me a moment here. Yes, that’s what they said in the presentation. The equation was: your own holiday home = more holidays = less stress = stress causes cancer (?) Therefore timeshare = no cancer. I’m not being figurative, they literally spent several minutes arguing this bizarre equation.

I have since decided that, compared to what followed, the presentation was the ‘carrot’. What came next can only be described as a large number of sticks used to metaphorically beat us into parting with all our savings.

-

Tell a sad story. The second part of the pitch was a face-to-face ‘chat’ with our allocated sales rep. I braced myself for the hard sell, but our saleslady started by casually flipping through a photo album. And pointing out all the people in it who were now dead. There were a lot.

The entire episode was incredibly odd – I presume they were her friends, but I can’t say for certain. They could have been people who had refused to buy timeshares. Either way, I can only assume this was meant as a reminder to seize the day, but it made us feel pretty uncomfortable.

-

Call in the ‘bad cop’. The face-to-face hard sell started. When I disagreed with the (frankly ludicrous) ‘savings’ they’d argued we’d make – which amounted to hundreds of thousands of dollars – our sales rep called over what can only be described as the head sales-bully.

With all the charm and tact of a Rottweiler with a machete, he snapped at me for not “understanding the value”. I was then barked the ‘savings’ again at twice the volume. He shouted at me for so long, I literally had to stare passively at my lap until he went away. Our persistent, human saleslady seemed a godsend by comparison.

-

No solo bathroom breaks. After two hours of constant sales pressure, I excused myself to pop to the loo. My other half said he needed to go too. The timeshare saleslady insisted on ‘coming along’, and immediately wedged herself between us until my partner departed for the gents.

When we got into the ladies’ bathroom, she stuck her head round a cubicle, flushed immediately, and walked straight back outside to wait for my other half, ensuring there was no conferring.

-

The non-sequitur is king. If you aren’t going to buy property for a number of sensible reasons, why not ignore logic altogether? We had some real gems thrown at us by the sales staff. Me: “No thank you, I’m really not interested.” Saleslady: “Why don’t you think you deserve nice things?”

To read about how the author coped with this onslaught, continue reading here

Over the years of operating, ITRA has entered into dialogue with thousands of timeshare owners from which we have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

To find out more about what we do, visit www.itra.net

British Timeshare Operator Arrested by Hungarian Authorities

Accused of Timeshare fraud, a British businessman faces charges in Hungary

A Hungarian timeshare operation run by Britons Michael Turner and Jason McGoldrick collapsed in 2005. Hungarian prosecutors used European Arrest Warrants to detain the pair, saying the company's creditors were the victims of fraud, but both men have denied any wrongdoing.

Now Mr Turner, who has already spent four months without charge in a Hungarian jail, is claiming British judges should be given more power to test the evidence in cases before Britons are extradited under the European Arrest Warrant.

The 29-year-old businessman from Corfe Castle, Dorset, must return to Budapest next week to answer allegations over a failed timeshare company which collapsed in 2005.

read more: www.granthamjournal.co.uk

At ITRA, we have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

Our objective is to support the consumer in timeshare disputes.

Find out more at www.itra.net

Friday 17 February 2012

ITRA – How to avoid being caught in a Timeshare Scam

5 minute video with lots of tips on how to avoid being caught in a Timeshare scam.

ITRA

Our objective is to support the consumer in timeshare disputes. We have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

|  |  |

ITRA

Comments can be left at the end of this post, if you want to follow the original thread on YouTube click here

For more advice in video format follow ITRA on our YouTube channel by clicking here

To find out more about the International Timeshare Refund Action ITRA visit our website www.itra.net

Wednesday 15 February 2012

ITRA - New laws introduced to protect consumers of timeshare and holiday clubs

New laws have been introduced to protect people from timeshare and holiday club scams - but Shropshire solicitors are urging people to continue to seek advice before they get involved.

International Timeshare Refund Action – ITRA

On February 23 2011 a new law came into action to protect consumers of timeshare and holiday clubs as the existing Timeshare directive only applied to certain products and had a number of loopholes.

These loopholes were exploited by unscrupulous companies and individuals in the Timeshare industry; leaving consumers as the potential victims of numerous scams.

Linder Myers Solicitors, based in High Street, Shrewsbury, is in the process of raising a group action for all those who have been affected by issues with their timeshare or holiday club. The firm is assisting consumers in disputes with Club La Costa and the Petchey Group of Companies.

Solicitor Stephen Boyd today said: "Holiday Clubs fell outside of the protection afforded to customers by the Timeshare Act 1992 (later amended in 2003 and 2007). This means that if someone purchased a Holiday Club, they would not have the right to a cooling-off period that would have automatically applied if purchasing a traditional timeshare.

"There have been similar developments in relation to products described as "fractional ownership" or in products which are in reality timeshares, but which relate to boats, cruise ships, or aeroplanes.

"In 2008 a new European Timeshare directive was adopted and it was a requirement that all European Member States should bring this into law by February 23, 2011. The purpose of the directive was to clearly give consumers greater protection."

Key features of the directive are that holiday clubs are covered in the cooling off period, shorter Timeshare contracts are allowed, all types of holiday accommodation are covered including caravans or cruise ships, Timeshare can be resold by the consumers and the introduction of exchange services.

"Another issue that has been addressed by the new Directive relates to the resale industry," added Stephen. "In recent years there have been a number of complaints received by Linder Myers regarding individuals who have contracted with companies offering to assist them with the resale of their Timeshare.

"Unfortunately in the past this has been another 'scam'. This will change under the new directive to help to eradicate this issue for consumers.

"The new regulations will be enforced by the Office of Fair Trading and Local Authority Trading Standards Officers in the UK. Failure to comply with the directive could allow for consumers to bring a civil claim against the trader.

Consumers now have the time to take away any contracts to do with Timeshares and holiday clubs before parting with any money. We strongly advise that you take legal advice before signing anything."

Source: Midlands Business News

To comment on the original article click here

International Timeshare Refund Action – ITRA

To find out more about the International Timeshare Refund Action visit our website www.itra.net

Related ITRA links

To follow us on YouTube click here

Tuesday 14 February 2012

Timeshare Points Class Action Settlement

Owners Action report that a class action lawsuit filed on behalf of RCI Points members is moving towards a possible settlement.

Owners Action are a firm of specialist consultants who deal with disputes within the timeshare industry.

Owners Action have been appointed as European marketing agents by International Timeshare Refund Action (ITRA) to generate and promote consumer awareness regarding a proposed Group Litigation against RCI Europe and others.

Monday 9 January 2012

ITRA News | How to Sell Timeshare Without Losing Your Hair

Timeshares are costly to purchase the majority of the time. Nevertheless, as numerous individuals would already know, whenever you attempt to sell exactly the same timeshare, it’ll not even be of half the buying cost. This low return value for the timeshare causes a loss towards the buyer who purchased it for himself or his family members some time ago. Many people are so disappointed by this low return value that they plainly declare that purchasing a timeshare isn’t a great concept at all or when you have purchased it, you need to attempt to use it for the whole duration. This attitude towards timeshare isn’t right. NOTE: It’s always important to stay up to date on timeshare resale scams before you try to sell in the resale market.

1. A creative and well-designed advertisement is often the crucial to acquiring an excellent value for the timeshare. Often attach an impressive picture of the unit along with your advertisement. You ought to also list all of the capabilities of the timeshare that make it wonderful for any buyer.

2. Getting all of the legal documentations of the timeshare may also boost its value surprising. You may not have given it significantly believed but you may see that folks will trust you a lot more than timeshares which have incomplete documents.

3. Usually post your advertisements in related locations. Posting your advertisements all more than the web won’t get you any great clients. Only clients who’re genuinely thinking about purchasing timeshares will spend great cash for it.

4. The last but 1 from the most significant items is always to value your timeshare appropriately. Asking for an extremely high value will make folks shed interest and asking an extremely low value will make them suspicious.

By following these couple of straightforward recommendations, you’ll be able to certainly get an impressive value for the timeshare.

Listen closely because his is how to get out of a timeshare. Make sure to go here if you still have questions about how to successfully sell your timeshare.

Source: http://house-home-centired.co.za

To find out more about the International Timeshare Refund Action visit our website www.itra.net.

Tuesday 3 January 2012

Timeshare Company to Sponsor Cycle Team

Major European timeshare company The Anfi Group will have its brand represented in more than 250 cycle races worldwide over the next 12 months and feature prominently in the Tour de France, the Giro d’Italia and the Tour of Spain.

The move is the result of a new sponsorship deal that will see the Anfi Group logo displayed on the jerseys and bikes of the Saxo Bank cycling team, which features Alberto Contador, triple champion of the Tour de France and one of the most popular media sports stars of the moment.

Contador will join his Danish teammates during the first stage of the collaboration between the Gran Canaria-based company and Saxo Bank next January, when the squad, led by Bjarne Riis, will stay in Anfi Group resorts on the island, all of which are affiliated to RCI.

Read the full article: www.rciventures.com

International Timeshare Refund Action (ITRA) is pursuing the coordination of a claim to the courts on behalf of timeshare owners who can justify due cause for refund compensation, distress and damages on the grounds that their timeshare purchase was not of merchandisable quality.

To find out more about the International Timeshare Refund Action visit our website www.itra.net

Timeshare Exchange Company Says Brits Value Their Holiday Ownership

Interval International, a prominent worldwide provider of timeshare holiday exchange services recently revealed that its UK members travel extensively, find holiday ownership satisfying, own an average of 1.9 weeks of shared ownership time or its equivalent, and report average household incomes of approximately GBP 70,050 per year. And, more than one-quarter report ownership of a second home -- apart from their holiday ownership.

These findings are from Interval International's 2011 UK Membership Profile, which was developed from a sample of UK-resident timeshare owners maintaining an active membership with Interval. The online study was undertaken to provide insights for use in the development of services and benefits to be offered to Interval members.

Interval's UK members spend approximately 28 nights away from home travelling solely for leisure purposes. Additionally, these study respondents indicate a penchant to travel across the European continent during the course of the next two years, boding well for future holiday ownership purchases. Further afield, they have a strong desire to visit the USA and Canada, the Caribbean, and Australia and New Zealand.

"As going on holiday remains a high priority for our members, developers can look forward to welcoming more timeshare owners to their resorts," said Darren Ettridge, Interval's senior vice president of resort sales and business development. "That and the fact that our UK membership base continues to be interested in owning more holiday time should encourage resort sales and marketing professionals to take heed of this potential purchasing group."

Respondents desiring to purchase additional timeshare holiday time remain most interested in the two-bedroom configuration, with more than half (57 percent) citing a preference for that unit type. Purchase price, the luxury of the unit, and the annual maintenance fee commitment represent the three most influential factors in the decision making process.

Other notable findings from the 2011 UK Membership Profile include:

-- Approximately 83 percent of Interval's UK members report satisfaction with their timeshare ownership.

-- Nearly eight out of 10 acquired their timeshare interests from resort project developers and management companies.

-- An estimated 61 percent of leisure travel nights are spent travelling across the UK and Ireland and the European continent.

-- The average length of a leisure holiday within Europe is estimated to be 7.5 nights.

-- Almost half of Interval's UK members would be interested in taking a cruise during the next two years.

-- UK members prefer relatively less-strenuous activities on holiday with sightseeing, swimming, shopping, spending time in a spa and watching plays and concerts rating highly.

SOURCE: Interval International

At International Timeshare Refund Action (ITRA) our objective is to support the consumer in timeshare disputes. We have discovered a pattern of abuse, deception and even fraudulent issues that have been systematically perpetrated by many of the major timeshare industry players to the detriment of owners.

To find out more about the International Timeshare Refund Action visit our website www.itra.net